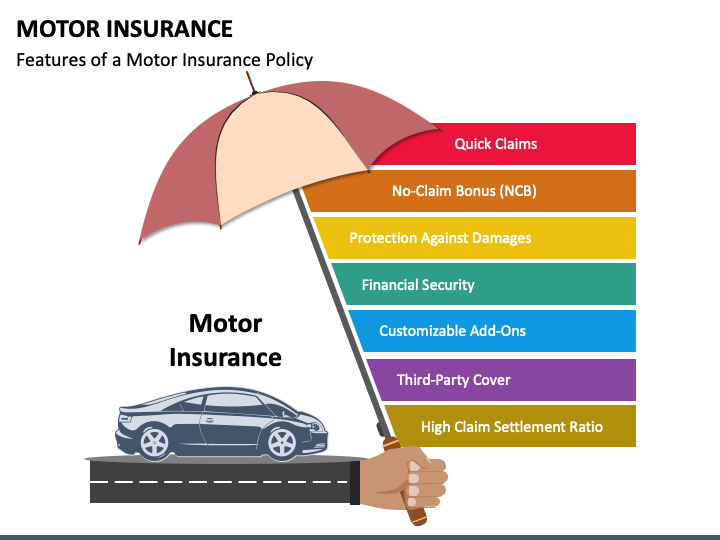

A Motor insurance policy is a type of multiple-line insurance policy

Motor insurance, often referred to as auto insurance or car insurance, is an indispensable aspect of responsible vehicle ownership. It provides coverage and financial protection for both drivers and their vehicles in the event of accidents, theft, or damage. This insurance offers a wide range of benefits, including liability coverage to protect against third-party injury or property damage claims, as well as comprehensive and collision coverage that pays for repairs to or replacement of the insured vehicle in the event of accidents, regardless of who is at fault. Motor insurance is not only a legal requirement in many places but also a practical necessity for safeguarding both your financial well-being and the safety of other road users. It plays a pivotal role in ensuring that you can continue your daily life without undue financial stress in the face of unexpected vehicular mishaps